The comparison of in-house and outsourced Bookkeeping Services Calgary for startups

Wiki Article

Exactly How a Bookkeeper Enhances Financial Management for Entrepreneurs

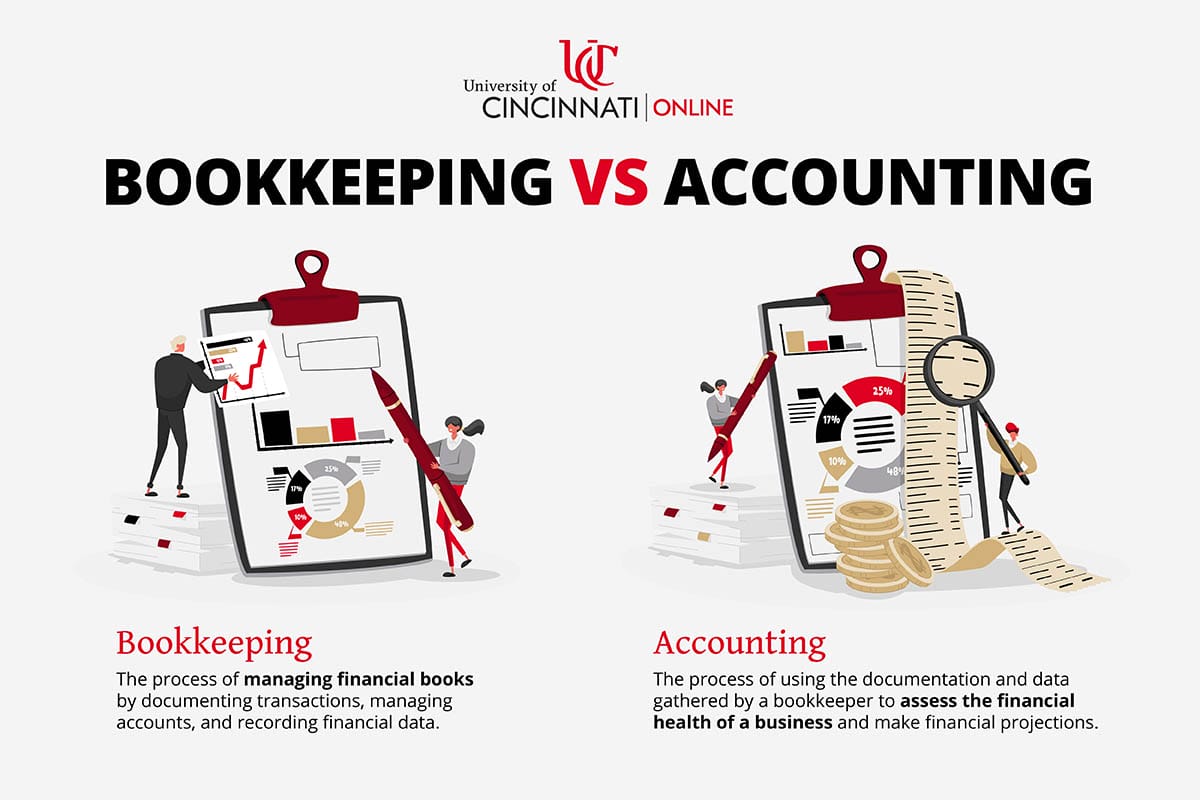

An accountant plays an important role in improving monetary administration for business owners. By precisely videotaping purchases and resolving declarations, they offer clarity and framework to economic procedures. This orderly method not only aids in conformity yet additionally sustains calculated decision-making. As business owners browse their development trips, the impact of reliable accounting becomes increasingly substantial. What certain benefits can business owners anticipate when they take advantage of professional bookkeeping services?The Duty of a Bookkeeper in Financial Monitoring

Lots of people might not recognize it, a bookkeeper plays an essential duty in the financial monitoring of a service. They meticulously videotape all financial transactions, guaranteeing that income and expenses are accurately recorded. This fundamental task permits company owner to comprehend their financial standing at any kind of given minute. An accountant likewise fixes up bank statements, which aids determine discrepancies and warranties that the company's monetary documents line up with real financial institution data.Moreover, they prepare monetary records, such as profit and loss statements, which give insights into the service's efficiency with time. By organizing and keeping financial records, an accountant enables business owners to make educated choices based upon trustworthy information. Their knowledge in handling accounts payable and receivable further help in preserving healthy and balanced capital. Essentially, a bookkeeper works as a critical support group, permitting business owners to concentrate on growth while ensuring financial accuracy and conformity.

Time-Saving Perks of Professional Accounting

Furthermore, professional bookkeepers use sophisticated software program and systems to simplify procedures such as invoicing, cost monitoring, and economic coverage. This effectiveness decreases the time invested on manual access and decreases the likelihood of errors that can need added time to correct. Furthermore, a bookkeeper can establish regimens for routine financial updates, making certain that company owner obtain timely insights without the demand to explore the minutiae themselves. Inevitably, the moment conserved can translate into better performance and enhanced overall company efficiency.

Making Certain Conformity and Decreasing Monetary Risks

Exactly how can a business guarantee conformity with ever-changing financial laws while reducing dangers? Engaging an expert bookkeeper can substantially improve this process. A competent accountant remains educated concerning the current tax obligation legislations and economic laws, making sure that a company complies with needed compliance requirements. This aggressive method assists prevent costly penalties and lawful difficulties that might develop from non-compliance.Additionally, an accountant implements robust interior controls to mitigate economic risks. By developing balances and checks, they decrease the possibility of errors or deceptive activities. Best Bookkeeping Calgary. Normal audits and reconciliations conducted by a bookkeeper supply an extra layer of protection, recognizing discrepancies prior to they rise

Additionally, exact record-keeping and prompt coverage enable entrepreneurs to make informed choices and anticipate potential economic problems. Ultimately, a professional accountant functions as a crucial possession in cultivating a financially secure environment, permitting service proprietors to concentrate on growth and development.

Generating Accurate Financial Information for Informed Decision-Making

Exact monetary reporting is important for businesses aiming to make informed decisions, as it gives a clear photo of their financial health and wellness. An experienced bookkeeper plays a critical duty in generating these records by diligently tracking earnings, costs, and total cash circulation - Best Bookkeeper Calgary. Through persistent record-keeping, accountants ensure that all monetary transactions are precisely documented, which forms the backbone of trustworthy reportingWith precise data compilation, bookkeepers can produce crucial financial reports such as annual report, income declarations, and cash circulation declarations. These documents not just illuminate current financial standings but also highlight trends that might affect future choices. In addition, by using accountancy software application and adhering to ideal methods, bookkeepers can lower the probability of errors, thereby boosting the reputation of the records. Ultimately, exact monetary reports encourage entrepreneurs to make calculated choices that align with their business objectives, cultivating confidence in their financial administration.

Supporting Organization Growth and Strategic Preparation

As organizations look for to broaden and adjust to changing markets, efficient financial administration becomes essential for supporting development and tactical preparation. A competent accountant plays a critical function in this procedure by maintaining organized monetary documents and tracking capital properly. This enables entrepreneurs to determine fads, allocate resources efficiently, and make educated decisions regarding financial investments and scaling operations.An accountant assists in budget preparation and financial forecasting, supplying understandings that align with the business's long-lasting objectives. By analyzing financial information, they can highlight areas for enhancement and recommend approaches to boost success. Additionally, their proficiency in compliance guarantees that businesses remain aligned with regulatory demands, lessening dangers connected with monetary mismanagement.

Essentially, a competent bookkeeper is an indispensable possession, equipping entrepreneurs to concentrate on development efforts while maintaining a strong monetary foundation that sustains calculated planning. (Best Bookkeeper Calgary)

Frequently Asked Inquiries

What Certifications Should I Search for in an Accountant?

When choosing a bookkeeper, one need to prioritize qualifications such as pertinent accreditations, experience in the market, effectiveness in audit software application, attention to detail, and solid organizational abilities to guarantee precise economic administration and coverage.Just How Much Does Working With a Bookkeeper Typically Expense?

Hiring a bookkeeper commonly costs in between $20 to $100 per hour, depending on their experience and the complexity of the economic tasks. Regular monthly retainers might also apply, varying from a few hundred to a number of thousand bucks.Can an Accountant Help With Tax Obligation Preparation?

Yes, a bookkeeper can help with tax obligation preparation by organizing monetary documents, ensuring compliance with tax guidelines, and giving needed documentation to simplify the filing process, inevitably decreasing the burden on the business owner throughout tax period.Just how Typically Should I Meet My Bookkeeper?

Consulting Best Bookkeeping Calgary with an accountant must happen regular monthly for routine economic evaluations, while quarterly meetings are ideal for reviewing more comprehensive monetary strategies. Extra constant discussions might be helpful throughout active periods or significant economic changes.

What Software Program Do Bookkeepers Typically Make Use Of?

Bookkeepers commonly utilize software program such as copyright, Xero, and FreshBooks for managing financial resources. These devices facilitate invoicing, cost monitoring, and financial reporting, permitting efficient and orderly financial management in different organization settings.

Report this wiki page